Add $3,000-$5,000 Monthly Income

Without Buying Another Property

FOR REAL ESTATE INVESTORS WITH UNUSED CREDIT

Julian Sanchez

Partner, Elan Capital ($30M CRE Portfolio)

Founder, Prospera Partners & ChezTrade

Orlando, FL

I'm a real estate investor. I had $150K in business credit sitting unused from my deals.

I figured out how to turn that credit into $3K-$5K monthly income without buying another property or dealing with tenants.

Now I help other real estate investors do the same.

You've Hit the Real Estate Ceiling

You know the pattern:

Buy a property. Deal with tenants. Handle maintenance. Wait for appreciation. Repeat.

Every property adds income... but it also adds:

- Another tenant to manage

- Another roof that'll need replacing

- Another thing that can call you at 2am

- More time, more stress, more complexity

And meanwhile, you have business credit sitting unused from your last deal. Maybe $50K. Maybe $150K. Just... sitting there.

What if you could use that credit to generate $3K-$5K monthly—without buying another property or adding any management?

That's what I figured out.

Here's What I Do (And What Our Partners Get)

We use Your credit to fund inventory for Your business.

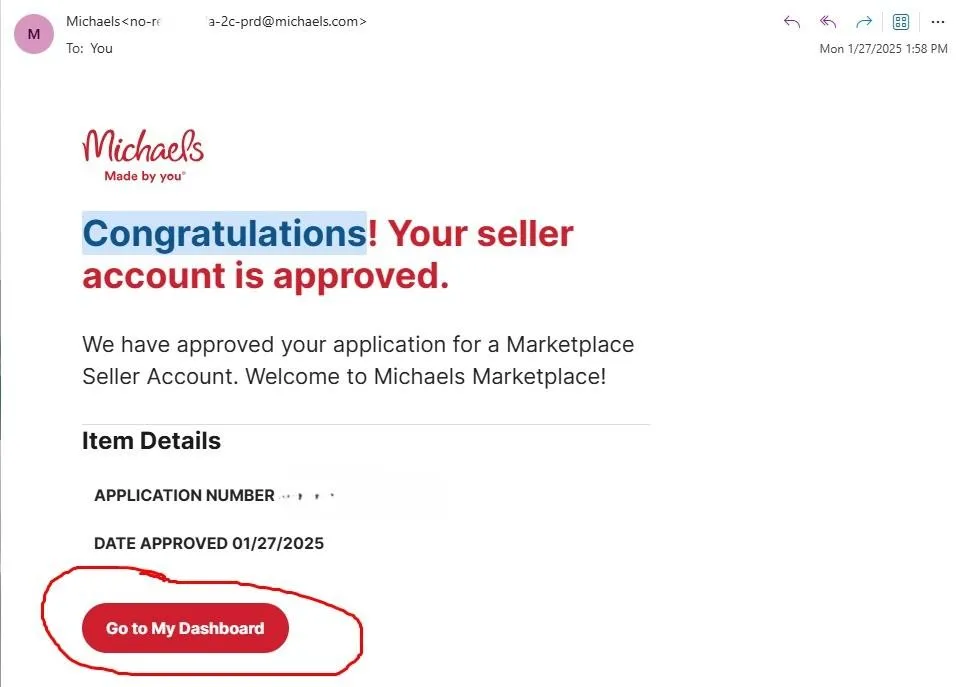

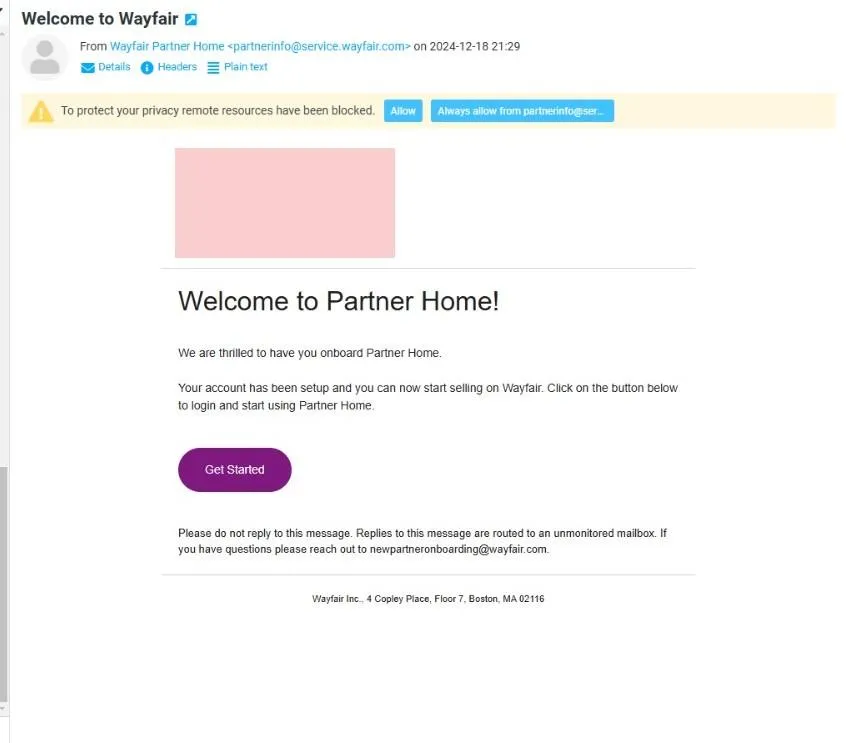

We sell on established third-party marketplaces like Wayfair, Michaels, Target, and Bed Bath & Beyond.

You own the store under your LLC.

ChezTrade (our fulfillment operation) handles everything:

- Inventory sourcing

- Order fulfillment

- Customer service

- Returns processing

- All operations

You get Weekly profit deposits into your account.

That's it.

Typical Timeline:

→ First payout: 45-60 days

→ Monthly net: $3,000-$5,000

→ Investment recovery: 12-18 months

→ After that: Pure profit, ongoing

Compared to Buying Another Rental:

- Down payment: $50K-$100K (liquid cash)

- Monthly net: $200-$500 (if you're lucky)

- Your time: Constant (tenants, maintenance, management)

This is like owning a rental property that never calls you and pays 2-3X the monthly cashflow.

Real Estate Investors Already Doing This

Chris | Multifamily Investor, California

Dan | Real Estate Investor, Wisconsin

👉 Anette had the assets but not enough cash flow, we helped her with that.

This Isn't For Everyone

This is specifically for real estate investors who:

✓ Have $100K+ in unused business credit (from funding deals, renovations, or business operations)

✓ Want additional monthly income without buying another property

✓ Are comfortable with an 18-month timeline to recover initial investment

✓ Prefer owning the asset (your LLC, your bank account) vs. being a passive investor

This is NOT for:

✗ People looking to "get rich quick"

✗ Anyone who needs their money back in 30-60 days

✗ People who want to learn e-commerce and do it themselves.

we're hands-on with setup and operations.

You Own the Asset. We Handle Everything.

The store is built under YOUR LLC. The merchant account is in YOUR name. The bank deposits go into YOUR account. The revenue shows on YOUR tax returns.

You get:

- 50% of net profits (weekly deposits)

- 100% of credit card rewards, points, and cashback

- Full visibility into every transaction

- The ability to use revenue for business loans or lines of credit

We handle:

- All inventory sourcing and purchasing

- All order fulfillment and shipping

- All customer service and returns

- All marketplace relationship management

You check the dashboard once a week. That's it.

💬 Frequently Asked Questions:

🔐 How is this different from rental properties?

Similar ownership structure (you own it under your LLC), but: • No tenants • No maintenance • No property management • Higher monthly cashflow • Faster setup (60 days vs 6+ months)

Think of it as a digital property with better returns and zero headaches.

💳 Do I need to use my own money?

No. You fund it using credit not personal cash. Even the Buy-In can be paid with a credit card. Customers pre-pay, you fulfill with a credit card, and you profit without touching personal funds.

🌐 What exactly am I buying?

You’re investing in: A real, revenue-generating online business. A merchant-fulfilled store operated by our team. A system that converts credit ➔ cashflow ➔ equity

💰 How do I make money?

Customers place prepaid orders on your store You fulfill those orders using a business credit card After fees/COGS, we split net profits 50/50. You also keep 100% of credit card points, cashback, and rewards

⏳ How much time does this take me per week?

Less than an hour per week. You own the business. We operate it. Most partners check their dashboards and messages once or twice a week.

📈 How fast do I start making money?

First payout: Typically 45-60 days after store launch

Monthly deposits: $3K-$5K (varies by store performance)

Investment recovery: 12-18 months (guaranteed)

After recovery: Pure profit, ongoing

⚠️ What if my store gets shut down?

Unlikely, but possible. That’s why we work across multiple marketplaces. If an issue occurs, we pivot your entity to a new sales channel and keep scaling.

🚫 Can I lose my investment?

Like any business, there’s risk.

But here's what protects you:

• We have an 18-month guarantee (we work for free if you don't recover)

• The marketplaces are established (Wayfair, Michaels, Target—not fly-by-night platforms)

• You own everything (your LLC, your merchant account, your visibility) Compare that to: stock market volatility, tenant damage, crypto crashes, or business partnerships where you have zero control. This is as close to "rental property risk" as you can get in e-commerce.

💼 Who owns the business — you or me?

YOU own it. 100%.

It's under your LLC. Your EIN. Your merchant account. Your bank deposits.

We operate it (inventory, fulfillment, customer service), but you own the asset.

Think of us like a property manager; except we're actually good at our job.

❓ Why don’t you just build more stores for yourself?

Same reason McDonalds doesn't own every McDonalds...

Or why the carpenter doesn't only builds tables for himself

We scale faster through partnerships. Partnering with other real estate investors who have unused credit lets us scale the fulfillment operation while you benefit from monthly income.

TRY IT RISK FREE

The Prospera Guarantee:

Invest Today and See Benefits Tomorrow. With Prospera Partners, your investment pays for itself in just 18 months or we work for free until you do. No hidden fees. No BS. Either this works for you, or we keep working until it does. That's how confident we are in this model.

Copyright © 2022 Sanchez Service LLC. All rights reserved.

This website is operated and maintained by Sanchez Service LLC. Use of this website is governed by its Terms of Service and Privacy Policy.

Sanchez Service LLC specializes in e-commerce investments and the creation of automated online stores. We do not offer a “get rich quick” program or guaranteed money-making system. While we believe that e-commerce can be a valuable way to generate passive income, success depends on various factors, and we do not guarantee specific outcomes or financial returns. All material is intellectual property and protected by copyright. Any duplication, reproduction, or distribution is strictly prohibited. Please see our Full Disclosure for important details.

Investing of any kind carries risk, and it is possible to lose some or all of your money. Our offerings are general in nature and may not suit every individual or situation. We make no representation about the likelihood or probability that any specific investment will achieve a particular outcome or perform in a predictable manner.

The testimonials and examples on this website reflect opinions, findings, or experiences of individuals who generally invested in our e-commerce services. Results vary, are not typical, and depend on individual effort, time, and strategy, as well as unknown factors. Many customers may experience differing results; some may not achieve financial success, or may choose not to fully implement our services.

The Company may link to or refer to content and/or services created by third parties unaffiliated with the Company. Sanchez Service LLC is not responsible for such content and does not endorse or approve it. The Company may refer you to or work with third-party businesses. Some of these businesses may have common interests or ownership with the Company.

This site is not a part of YouTube, Bing, Google, or Facebook, nor is it endorsed by Google Inc, Microsoft Inc, or Meta Inc. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc. BING is a trademark of MICROSOFT Inc.

Sanchez Service LLC, 16385 Biscayne Blvd CU-2, Miami, FL 33160.

All testimonials on this page reflect the experiences of real clients in e-commerce. However, the results shown here are not typical and do not guarantee similar outcomes for everyone. Individual results may vary based on factors such as your skills, experience, and motivation, along with other unforeseen elements. The Company has not conducted studies on the average results of its typical clients. Your experience and results may differ.